3 Easy Facts About Frost Pllc Shown

The Best Guide To Frost Pllc

Table of ContentsThe Of Frost Pllc6 Easy Facts About Frost Pllc ShownThe 3-Minute Rule for Frost Pllc9 Simple Techniques For Frost PllcThe 6-Minute Rule for Frost PllcNot known Details About Frost Pllc The Best Guide To Frost Pllc

Government audit includes bookkeeping services for government entities. The accounting professional makes sure that expenditures and revenue are by the regulation. They are likewise liable for handling government possessions and creating a budget plan. They accounting professional record and analyze business financial data and use the info to help in budgeting, price monitoring, property monitoring, and efficiency analysis (Frost PLLC).They inspect if the business is functioning by the legislation and regulation. Accountancy audit7. Pay-roll processingThis type of audit service involves keeping records of the monetary accounts of the service.

The bookkeeper checks the repayment of the accounts and just how they are obtained. This takes care of revenue tax and various other tax obligations that are put on the company. The tax accounting professional makes sure that they provide the best advice when it comes to cases and secures the firm from paying unnecessary taxes.

8 Easy Facts About Frost Pllc Described

They guarantee efficient and accurate audit job. Bookkeeping offers in-depth monetary info concerning the service. The auditors are included validating and ensuring the accuracy of monetary statements and records.

This solution ensures exact bookkeeping of monetary documents and assists to find any discrepancy.the accounting professionals aid in providing the business cuts down on costs and safeguard fraud. This solution guarantees precision in tax obligation rates and regulative details. It offers the upkeep of financial records of staff member's earnings, deductions, and rewards.

Accountancy solutions have to follow the regulations and laws of the business as well as those of the state.

Indicators on Frost Pllc You Need To Know

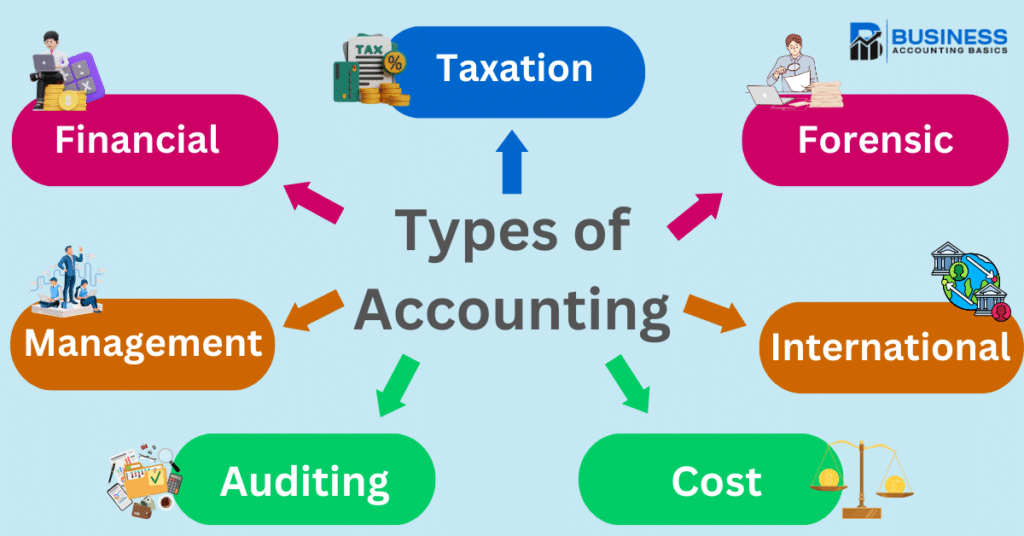

If you have a go to numbers and a heart for helping companies operate with precision, ending up being an accounting professional can include up to a pleasing and worthwhile occupation. Generally speaking, accountants are specialists that examine and report on economic purchases for people or companies. There are numerous kinds of accountants, covering all kind of sectors including the general public industry, nonprofits, exclusive market, and regional, state, and federal government.

Allow's dive in and see which kind of task in this market passions you the most! Monetary audit is one of the most recognizable types of accounting professionals, who are typically responsible for preparing monetary statements for their customers.

8 Simple Techniques For Frost Pllc

This is a high-paying profession with a large amount of duty, and the capability to flex right into several fields, from exclusive companies to multinational firms. CPAs are one of the kinds of accountants that are nearly universally required and necessary for an effective business. This is a highly sought-after setting because of its high earning potential As its relative stability no issue what the economic situation, taxes must be submitted.

CPAs are licensed and may have various other qualifications. Tax accountants are accountable for assisting customers deal with a variety of tax-related demands beyond filing quarterly or annual tax obligations, consisting of aiding with audit conflicts, licensure, and extra. Credit rating Full Report supervisors help determine whether a company or person can open up or extend a line of credit rating or a finance.

Frost Pllc Can Be Fun For Anyone

Debt managers can also function internally to aid a service collect repayments, problem debts or loans, and evaluate the company's monetary danger. By setting a firm's budget, expense accounting professionals assist guide decision-making and costs control. This function resembles most of the various other kinds of accountants formerly stated, because they have several obligations when it pertains to numbers: bookkeeping, reporting, evaluating, and much more.

Client Accounting Solutions (CAS or CAAS) describes a variety of conformity and advising services a bookkeeping firm provides to a business client. Basically, the audit company works as an outsourced money division for the customer. Entrepreneur are proactively looking for means to accomplish more development with much less work, time, and labor force.

CAS companies are outsourced to do finance-as-a-service and do most, if not all, of the bookkeeping and financial jobs for their customers. You'll additionally locate CAS described as CAAS, Client Accountancy Advisory Services, or Client Advisory Solutions. Below are a few of the vital tiers of CAS: Bookkeeping is a foundational tier of CAS.By aiding clients with the day-to-day recording of financial purchases, you create the structure blocks of their economic records, aid in compliance, and supply the necessary data for strategic decision-making.

This entails managing outgoing settlements and expenditures for a customer, billing handling, making sure prompt settlements to suppliers, and taking care of money flow successfully. Accounts receivable. Consists of inbound repayments, billing production, tracking payments due, managing collections, and ensuring that the customer's cash money flow is steady and predictable. Account settlement. Makes certain that all organization deals are properly tape-recorded, making certain the honesty of economic information.

See This Report on Frost Pllc

Audits and tax obligation preparation are standard solutions, but they remain important to comprehensive CAS offerings. Audits involve taking a look at a company's monetary declarations and records to ensure precision and conformity with audit requirements and regulations. Furthermore, check my blog tax preparation involves assembling and why not try here filing tax obligation returns, making sure accuracy to prevent fines, and encouraging on tax-efficient approaches.

Commonly, billing by the hour has actually been the best technique in accountancy. Companies determine a per hour rate based upon fixed prices and a targeted profit margin. Theoretically, it's an uncomplicated technique: you do the work, the clock ticks, the bill expands. However this version is coming to be increasingly outdated in today's bookkeeping landscape.

It's similar to a fixed-priced version in that you charge in a different way depending on the service, but it's not a one-size-fits-all technique. It includes private conversations with your customers to identify what their concerns are, what services they need, exactly how usually, and the range of the projects. From there, you can consider up every one of these aspects and offer them a quote that precisely shows the effort, time, and job needed to fulfill their needs.

How Frost Pllc can Save You Time, Stress, and Money.

It's a costs model: a premium degree of solution and a costs price. You may bill a client $7,500 per month, which consists of all the solutions you supply.